Like any good novel, a writer’s ability to integrate multiple storylines helps create an engaging and impactful experience for their audience. A great novel leaves you thinking about its story days, weeks, and months after you’ve finished.

Like any good novel, a writer’s ability to integrate multiple storylines helps create an engaging and impactful experience for their audience. A great novel leaves you thinking about its story days, weeks, and months after you’ve finished.

The same holds true for nonprofit financial storytelling – with the weaving together of financial data/results/analysis from all departments, you can show a great story – the effectiveness and reach of your organization and its impact on your community.

The result?

Unite team members. Improve transparency. Secure more donors. Secure more grants. Attract skilled talent. Build Trust. Build Confidence. Build strong sense of community. Overcome any preconceived/historical biases/obstacles.

Major Impact

How you tell your nonprofit's financial story – in terms of reports, dashboards, visualization tools, and pictures can provide a clear, concise, reliable, transparent storyline. The impact of your financial storytelling influences gift giving, community involvement, and support now and in the future.

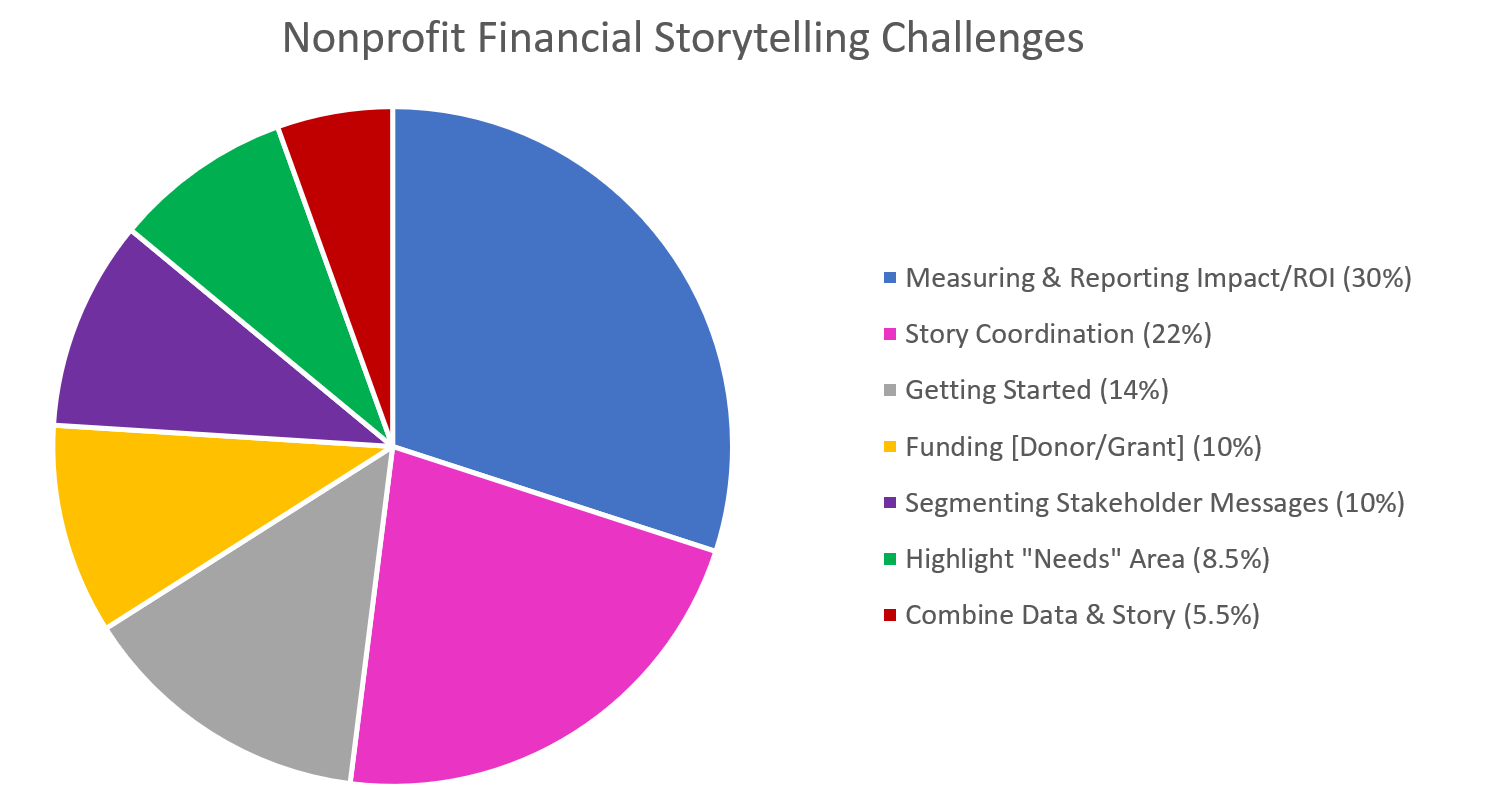

Identifying Your Biggest Challenges for Nonprofit Financial Storytelling

Putting nonprofit financial storytelling together is not easy. Whether you’re dealing with the proverbial “blank page” in getting your financial storytelling off the ground or identifying what needs to be told or how to tell it, you’re in good company. We surveyed recent webinar registrants of Nonprofit Financial Storytelling: Building Confidence Among All Stakeholders, [link: https://accufund.com/npo-financial-storytelling] on the topic of nonprofit financial storytelling, and based on 199 respondents, these were the categories creating the biggest challenges:

Measuring & Reporting Impact/ROI [30%]

Coordinating the financial aspect of the story. Includes showing where the money goes, impact of general operating expenses, impact of programs, and the challenge of a major financial impact that can look either good or bad.

Story Coordination (Identify/Collect/Tell) [22%]

The identifying, collecting, and telling of your story – including old and new nonprofits. How to tell your story while protecting confidentiality, or when your mission shifts. Plus, challenges persist in accounting for the variability especially over the last few years going through the pandemic.

Getting Started [14%]

Gain knowledge about how to start, find the time, identify tools and resources to use, and tie it all together. Also includes addressing budget development for programs/areas and staff needs.

Funding (Donor/Grant) [10%]

Attracting donors and attracting grantors play a critical role in funding your mission. Building confidence, showing program and organization impact, and providing the reporting required by all funders.

Segmenting Stakeholder Messages [10%]

Sharing the right information at the right time to the right people. The need to provide a variety of different, clear messaging - relating to funding, financials, and potentially sensitive topics including legal matters, bankruptcy, etc.

Highlight "Needs" Area [8.5%]

Challenges around the best way to convey the importance of what you do. How can you showcase your organization needs without hindering future donations? How can you balance the narrative of need between ongoing financial contributions and long-term impact?

Combine Data and Story [5.5%]

At the heart of nonprofit storytelling is the actual blending of financials to outcomes to highlight the complete story. Understanding what data to use to round out the story and creating different stakeholders messages were popular comments.

Customize Your Story for Each Constituent Group

Depending on involvement, different constituent groups rely on different information for informed decision making and ongoing support.

What data is most commonly used to guide decision-making for a finance manager? Human Resources manager? Programs Manager? Donor or Grantor? And how is that information presented?

Program Managers for example, require data points that help them easily manage and assess the effectiveness of their programs. Reporting and dashboard metrics might include Budget to Actual, Clients Served/Enrollment, Cost per Client, Time to Serve Client, Client Demographics, Staff Levels/Client, etc.

For Finance Managers, their go-to data points might include Daily Cash Flow Report, Outstanding Balance on line of Credit, Current Ratio, Debt Service Coverage Ratio, Accounts Receivable – Days Receivable, Accounts Payable – Invoice Cycle Time, etc.

The community is looking for a results oriented description of the services your organization provides and how much it costs. Generally speaking, providing a cost per client per se helps them realize the dollar amount per service or per community member, etc. What is the cost of solving a problem? Be it mortgage counseling, dance/music lessons for children, school services, dental clinic/services –you can quantify how you’re helping.

From community members to donors to program managers, finance managers and the executive team, getting the right information in front of the right audience helps build confidence and trust, improves transparency, and goes a long way to uniting all team members in the pursuit of common goals; creating positive impact with your community and fulfilling your mission.

Where are you in your financial storytelling?

Financial Storytelling weaves together the financial data/results/analysis from all departments that help you show the effectiveness and reach of your organization. And like a great novel, it’s not perfect the first time through. It requires time, adjustment (editing), and input from your constituents. It’s a team effort to know what everyone needs and how best you can produce and display the information they need.

Seeing is Learning

Such a popular topic deserved its own webinar. Recently, Ian Scotland, AccuFund’s Vice President and General Manager, spoke to the challenges mentioned above and shared the types of financial storytelling each potential stakeholder needs to fulfil their organizational responsibilities. To listen to the recorded session, register for Financial Storytelling: Building Confidence Among All Stakeholders.

Related Content

On-Demand Webinar: Nonprofit Financial Storytelling

On-Demand Webinar: Dashboard Dynamics

White Paper: Dashboards for Nonprofits

Grants Management Executive Paper