Bank Reconciliation

AccuFund Onsite

Track All Your Transactions in Every Checking Account

AccuFund’s Bank Reconciliation module provides full reconciliation from bank to register to General Ledger for each checking account.

Bank Reconciliation combines accounts payable checks, payroll checks, and cash deposits in a single, simple-to-use system. It includes adjustments and account transfers to maintain a complete reconciliation history.

Bank Reconciliation Online Version

Streamline Your Bank Reconciliation Workflow

With AccuFund’s Bank Reconciliation module, information about any checking account can be viewed on the register screen:

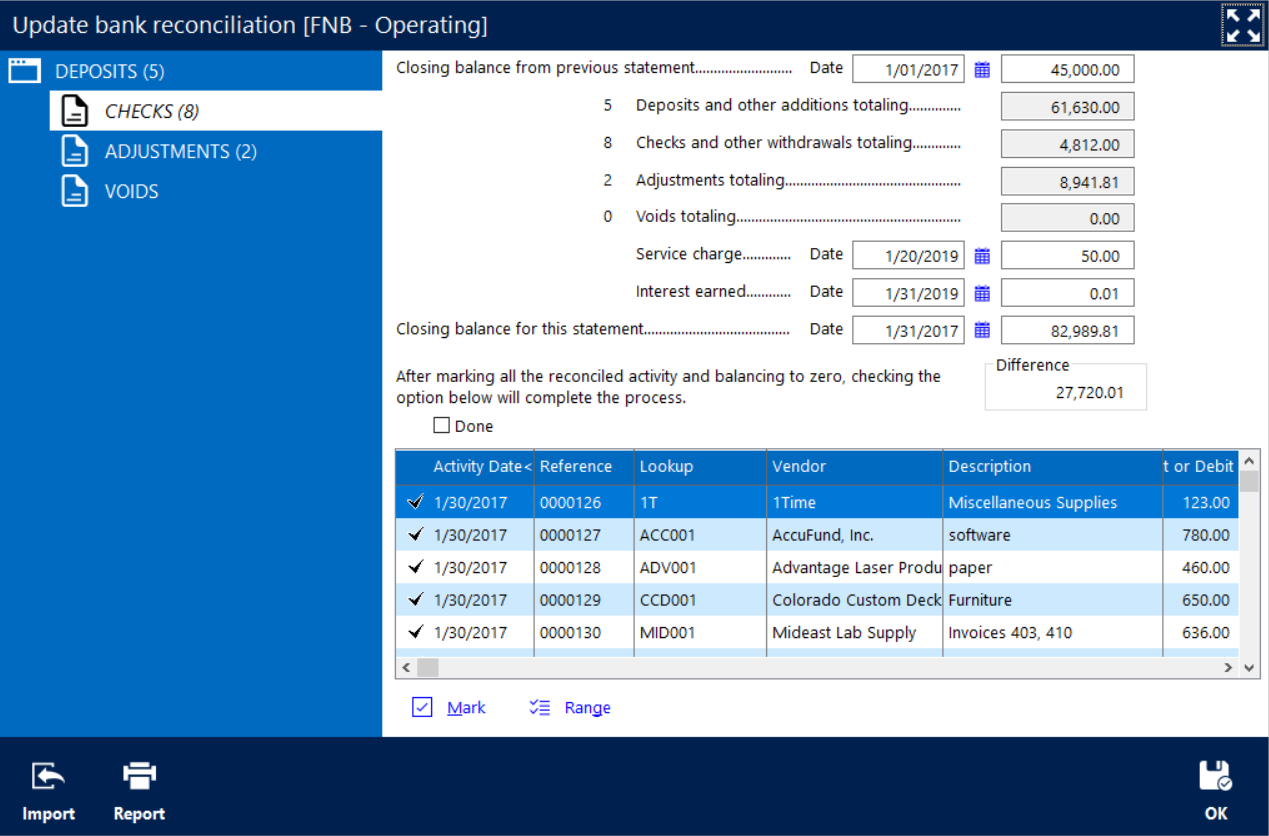

- Press the Bank Reconciliation icon to display a window for marking checks, deposits, and cash adjustments and entering service charges and interest earned.

- As each item is marked, the balance for that transaction type is updated and should agree with your bank summary when completed.

- Enter service charges and interest earned in the reconciliation.

Enjoy User-Friendly Features

The AccuFund Bank Reconciliation module includes features designed to make life easier:

- Mark a numerical range to simplify the reconciliation of groups of checks.

- Import cleared checks from your bank to speed reconciliation and reconcile more frequently.

- Scan and attach copies of your bank statements.

- Make adjustments for transfers between checking accounts and clearing checks for the wrong amount.

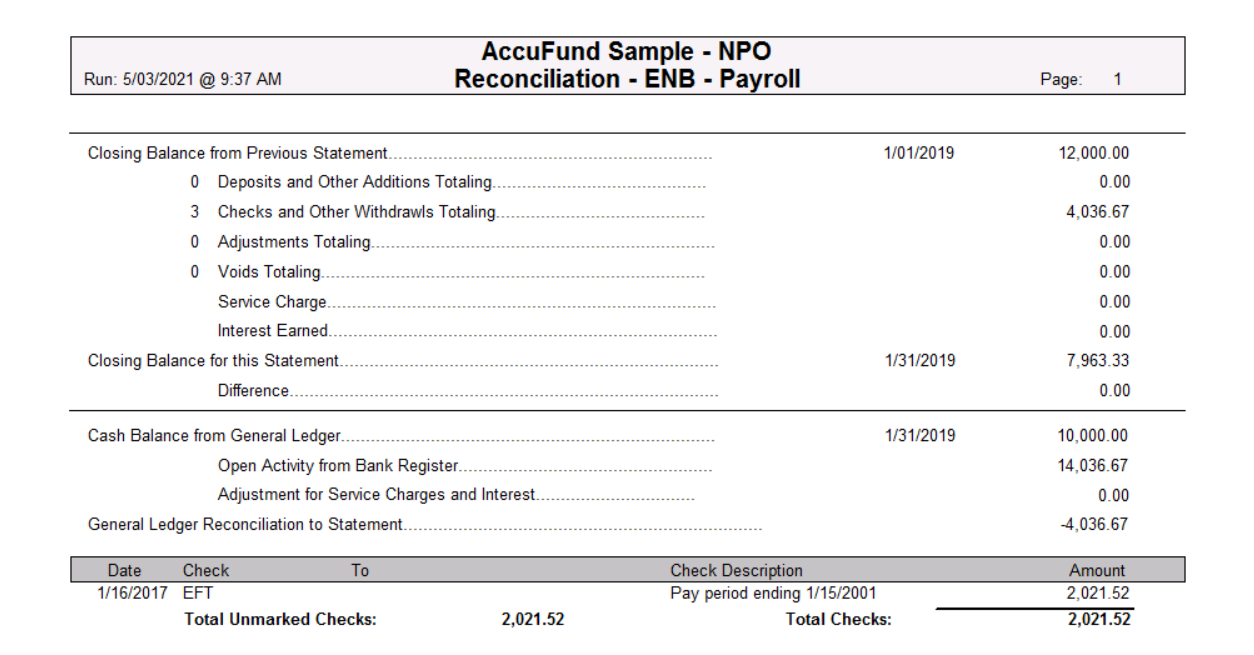

- Generate reports showing cleared, un-cleared, or both types of transactions.

- Keep prior reconciliations indefinitely for review and reporting.

Let’s Get Started

AccuFund supports your mission with a full suite of financial management applications for nonprofit and government organizations. To learn more and arrange a demo, contact AccuFund at 877-872-2228 or