Loan Tracking

AccuFund Onsite

Meet Your Complete Loan Management System

An important component of complete financial management for many government agencies, economic development organizations, housing agencies, and religious organizations, AccuFund's Loan Tracking module is ideal for managing revolving loan funds and providing different types of business and individual loans.

Loan Tracking gives you the tools you need to manage loans through their entire lifecycle, including reporting capabilities such as assessing the economic impact of your loan program. AccuFund’s Loan Tracking module is flexible enough to handle any sort of funding and multi-step payment program and can also assist you with your document management needs.

![]()

Loan Types and Transaction Items Are the Keys to Loan Tracking Success

AccuFund’s Loan Tracking module is based on definable items that are linked to loan types. Loan types are then linked to loans.

By defining aspects of each loan, loan types determine how loans are processed:

- Are they multi-payment disbursement loans or are they processed as soon as they’re entered?

- What transaction items, such as principal, interest, escrow, and late fees, are allowable, and in what order are payments applied against the items?

- What funds are the loans posted to in the General Ledger?

- Are they line of credit loans that may go to zero but don’t close automatically?

- Will the loans have regular billings, either daily or monthly, or do the amounts due get calculated when a payment is received?

- Should amortization tables be created?

- Will they bill only interest or only principal?

- What other optional information will be defined specifically for each loan?

Every loan is attached to a customer, and each customer may have multiple loans, multiple addresses, and multiple contacts. Activity notes can be attached to loans to keep track of customer contacts.

Transaction items define all the dollar amounts that will be processed on a loan. Behind each item are the calculations that are performed when a loan is billed or when a payment is received.

Transaction items can be one of four types—Principal, Interest, Other, and Demographic:

- Principal affects the balance of the loan. At any time, the amount of principal currently due or previously paid can be displayed.

- Interest is the fee collected for the use of loaned funds. This can be based on a simple interest rate or may be a factor of a posted rate, such as the LIBOR or prime interest rate. AccuFund Loan Tracking supports staged interest rates, and loans can be put on interest or principal and interest holidays.

- Other fees can include escrow and late fees. These may be fixed amounts or calculated based on an outstanding balance.

- Demographics are user-defined data fields—text, dates, rates, amounts, etc.—that can be stored with a particular loan. Group them together on tabs for entry and display purposes, and use dropdown lists to control data quality.

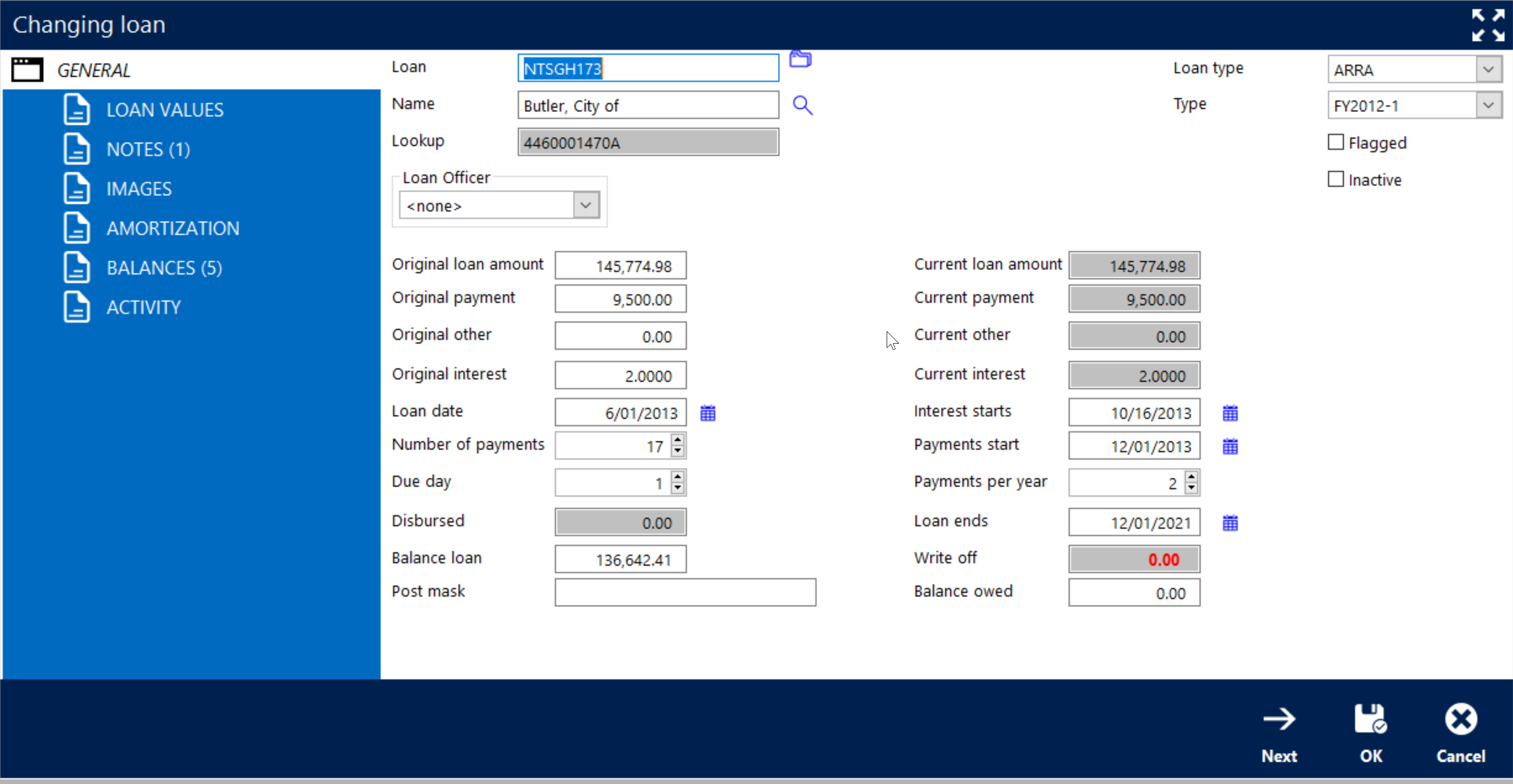

An unlimited number of fields can be added to a loan to store required data for reporting and management. At any time, you can see all the information related to each loan, including:

- Current balances, payments, and rates

- Unlimited demographic data fields

- Payment amortization tables

- Current billed and paid amounts

- All transaction details, including disbursements, rate changes, billed amounts, and paid amounts

Convenient Features Offer a Host of Benefits for Your Team

The AccuFund Loan Tracking module is purpose-built to simplify your workflow. Popular features include:

- Billed or Billed on Payment—Run daily billing to accrue interest due, monthly billing, or Bill on Payment, which calculates amounts due when a payment is received.

- Adjustments—Manually add transactions and change loan values. With Adjustments you can disburse funds, change interest rates, record loan and interest holidays, and enter billed and paid amounts.

- Write Offs—Manage the write off of billed amounts and loan balances. Partial write offs and post write off payments on defaulted loans are also supported.

- Views—AccuFund’s Query/Browse paradigm lets you link demographic fields to basic views, so you can easily view loan data in a grid entry format. Quick reports show all fields in a view in self-formatting reports.

Enjoy Greater Convenience with Built-in Integrations

To streamline your processes even more, Loan Tracking ties into other AccuFund modules:

- Accounts Payable—Bills entered through the Accounts Payable module can be attached to loans, so users can see fees, disbursements, and other related expense transactions

- General Ledger—Streamline your financial reporting

- Cash Receipts—Simplify cash collection

Let's Get Started

AccuFund supports your mission with a full suite of financial management applications for nonprofit and government organizations. To learn more and arrange a demo, contact AccuFund at 877-872-2228 or